Health Insurance Premium

In the ever-evolving landscape of healthcare, one aspect that holds significant importance for individuals and families is health insurance. Among the myriad of considerations within this domain, the health insurance premium stands out as a crucial factor, influencing both the financial well-being and access to quality healthcare services. This article delves into the intricate world of health insurance premiums, offering an in-depth analysis and practical insights to help navigate this complex yet essential aspect of modern life.

Understanding Health Insurance Premiums: A Comprehensive Guide

Health insurance premiums represent the financial cornerstone of any insurance plan. These premiums are essentially the regular payments made by policyholders to their insurance providers in exchange for the promise of coverage and access to a network of healthcare services. The premium amount is typically determined by a complex interplay of various factors, each contributing to the overall cost and coverage offered by the insurance plan.

Factors Influencing Health Insurance Premiums

Several key factors come into play when it comes to setting health insurance premiums. These include:

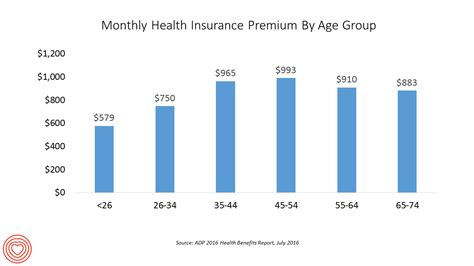

- Age: Older individuals generally pay higher premiums due to their increased likelihood of requiring medical services.

- Location: Premiums can vary based on the cost of living and healthcare services in different geographical areas.

- Tobacco Use: Insurance providers often charge higher premiums for individuals who use tobacco products, given the associated health risks.

- Pre-existing Conditions: The presence of pre-existing health conditions can significantly impact premium rates, with some providers offering specialized plans for those with such conditions.

- Type of Plan: Different insurance plans, such as PPOs, HMOs, and EPOs, carry varying premium costs and coverage options.

- Deductibles and Co-pays: Plans with higher deductibles and co-pays typically have lower premiums, as they require the insured to pay more out-of-pocket for medical services.

- Family Size: Premiums often increase with the number of family members included in the insurance plan.

- Coverage Options: The scope of coverage, including the types of services and providers covered, can influence premium costs.

The Impact of Premium Costs on Policyholders

Health insurance premiums can have a significant impact on individuals and families, especially those with limited financial means. High premiums can act as a barrier to accessing healthcare services, leading to potential delays in seeking medical attention or adhering to treatment plans. This, in turn, can have serious implications for overall health and well-being.

Navigating Premium Costs: Strategies for Affordability

While health insurance premiums can be a substantial financial commitment, there are strategies to help manage and reduce these costs. Some key considerations include:

- Compare Plans: Research and compare different insurance plans to find the one that best fits your needs and budget. Look for plans that offer a balance between premium costs and comprehensive coverage.

- Understand Coverage: Ensure you understand the specifics of your chosen plan, including what services are covered, any limitations or exclusions, and the process for claiming benefits.

- Consider High-Deductible Plans: For those who are generally healthy and don’t anticipate frequent medical needs, high-deductible plans can be a cost-effective option, offering lower premiums and the potential for tax-advantaged savings through Health Savings Accounts (HSAs)

- Utilize Employer-Sponsored Plans: If you’re employed, take advantage of employer-sponsored health insurance plans, which often provide more affordable options due to group rates and employer contributions.

- Seek Out Subsidies: Depending on your income level, you may be eligible for premium subsidies through the Affordable Care Act (ACA) or other government programs. These subsidies can significantly reduce your monthly premium payments.

- Negotiate with Providers: In certain situations, you may be able to negotiate your premium costs with your insurance provider, especially if you have a good claims history or are part of a large group plan.

The Role of Technology in Premium Determination

In recent years, the insurance industry has embraced technological advancements, leading to more efficient and data-driven premium determination processes. Insurance providers now leverage advanced analytics and machine learning algorithms to assess risk and set premiums more accurately. This shift towards data-driven decision-making has the potential to make health insurance premiums more equitable and tailored to individual needs.

| Factor | Impact on Premiums |

|---|---|

| Age | Older individuals pay higher premiums due to increased healthcare needs. |

| Location | Premiums can vary based on the cost of living and healthcare services in different areas. |

| Tobacco Use | Insurance providers often charge higher premiums for tobacco users. |

| Pre-existing Conditions | Having pre-existing conditions can significantly impact premium rates. |

| Plan Type | Different insurance plans, like PPOs and HMOs, have varying premium costs. |

| Deductibles and Co-pays | Plans with higher deductibles and co-pays generally have lower premiums. |

| Family Size | Premiums increase with the number of family members on the insurance plan. |

| Coverage Options | The scope of coverage can influence premium costs. |

Health Insurance Premiums: Future Trends and Considerations

As the healthcare industry continues to evolve, several trends and considerations are shaping the future of health insurance premiums. These developments have the potential to impact both the affordability and accessibility of healthcare services for individuals and families.

The Rise of Value-Based Care

One of the most significant shifts in healthcare is the move towards value-based care. This model focuses on improving patient outcomes and reducing overall healthcare costs by incentivizing providers to deliver high-quality, efficient care. Under this model, insurance providers may offer lower premiums for plans that emphasize preventive care and chronic disease management, as these approaches are known to reduce long-term healthcare costs.

Technological Innovations

The integration of technology into healthcare is another key trend that is influencing health insurance premiums. Telemedicine, wearable health devices, and digital health platforms are transforming the way healthcare services are delivered and accessed. These innovations can lead to more efficient and cost-effective care, potentially resulting in reduced premiums for policyholders.

Data-Driven Premium Determination

As mentioned earlier, insurance providers are increasingly leveraging advanced analytics and machine learning to assess risk and determine premiums. This data-driven approach allows for more accurate and equitable premium setting, ensuring that individuals are not overcharged based on assumptions or historical data. By analyzing real-time health data, insurance providers can offer more tailored premiums that reflect an individual’s actual health status and needs.

Government Policies and Regulations

Government policies and regulations play a critical role in shaping the healthcare landscape, including health insurance premiums. The Affordable Care Act (ACA) has already had a significant impact on insurance affordability and accessibility, with its mandates and subsidies. Future policies, such as those aimed at reducing prescription drug costs or expanding coverage for mental health services, could further influence premium costs and coverage options.

Individual Responsibility and Lifestyle Choices

Individual responsibility and lifestyle choices are also key factors in determining health insurance premiums. Adopting healthy lifestyle habits, such as regular exercise, a balanced diet, and avoiding tobacco use, can lead to lower premiums over time. Conversely, engaging in risky behaviors or neglecting preventive care can result in higher premiums and increased healthcare costs.

The Impact of COVID-19

The COVID-19 pandemic has had a profound impact on healthcare systems and insurance providers worldwide. While the full extent of its long-term effects is still uncertain, it has already influenced premium costs. For instance, the increased demand for telehealth services and the need for enhanced infection control measures in healthcare facilities have led to higher healthcare costs, which may be reflected in insurance premiums in the future.

The Future of Health Insurance Premiums: A Balancing Act

As we look ahead, the future of health insurance premiums appears to be a delicate balancing act. On one hand, there is a push for more affordable and accessible healthcare, driven by technological advancements, value-based care models, and government initiatives. On the other hand, rising healthcare costs, an aging population, and ongoing public health crises like COVID-19 pose significant challenges.

To navigate this complex landscape, individuals and families will need to remain informed about the evolving healthcare landscape and their insurance options. Staying engaged with their healthcare providers and taking proactive steps towards maintaining good health can also help mitigate the impact of rising premiums. Ultimately, the future of health insurance premiums will be shaped by a combination of technological innovations, policy decisions, and individual choices.

FAQ

How do health insurance premiums work?

+

Health insurance premiums are regular payments made by policyholders to their insurance providers. These payments are determined by various factors such as age, location, tobacco use, pre-existing conditions, and the type of insurance plan chosen. The premium amount is set by the insurance provider and is used to cover the cost of providing healthcare services to the insured individuals.

Can I negotiate my health insurance premium?

+

While it may be challenging to negotiate your health insurance premium directly, there are strategies you can employ to potentially reduce your costs. These include comparing plans, understanding your coverage needs, considering high-deductible plans with HSAs, utilizing employer-sponsored plans, and exploring premium subsidies if eligible. Additionally, some insurance providers offer loyalty discounts or incentives for maintaining a good claims history, so it’s worth exploring these options as well.

What factors can I control to influence my health insurance premium?

+

While certain factors like age and location are beyond your control, there are lifestyle choices and behaviors that can impact your health insurance premium. Adopting healthy habits such as regular exercise, a balanced diet, and avoiding tobacco use can lead to better overall health and potentially lower premiums over time. Additionally, being proactive about preventive care and managing any chronic conditions can also help keep your premiums more affordable.

How can I find affordable health insurance options?

+

To find affordable health insurance options, it’s important to compare plans, understand your specific coverage needs, and consider the trade-offs between premium costs and coverage. Explore employer-sponsored plans, especially if you’re eligible for group rates, and research government programs like the Affordable Care Act (ACA) to see if you qualify for premium subsidies. Additionally, consider high-deductible plans with HSAs, which can offer tax benefits and potentially lower premiums.