House Insurance Quote

When it comes to safeguarding your home, obtaining a house insurance quote is an essential step. House insurance, often referred to as homeowners insurance, is a vital financial protection measure that every homeowner should consider. It provides coverage for a range of potential risks and liabilities associated with owning a home, offering peace of mind and financial security. In this comprehensive guide, we will delve into the world of house insurance quotes, exploring the key factors, benefits, and considerations to help you make an informed decision.

Understanding House Insurance Quotes

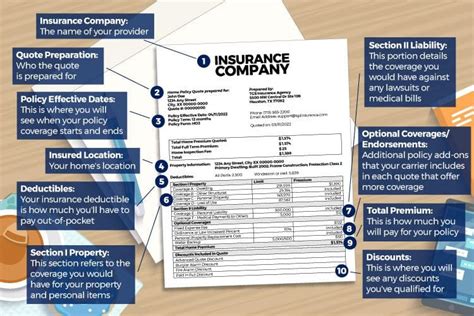

A house insurance quote is a personalized estimate of the cost of insuring your home and its contents. It serves as a crucial tool for homeowners to assess their insurance needs and find the most suitable coverage options. The quote is tailored to your specific circumstances, taking into account various factors such as the location, size, and construction of your home, as well as your personal requirements.

House insurance quotes are typically provided by insurance companies or brokers, who evaluate your application and assess the risks involved in insuring your property. They consider a range of variables to determine the premium, including the likelihood of certain events occurring and the potential costs associated with them. By obtaining multiple quotes, you can compare different policies and providers, ensuring you find the best coverage at a competitive price.

Factors Influencing House Insurance Quotes

Several key factors influence the cost of your house insurance quote. Understanding these factors can help you anticipate and potentially mitigate some of the costs involved. Here are some of the primary considerations:

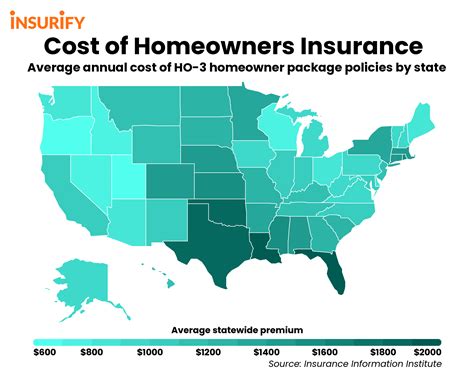

- Location: The geographical location of your home plays a significant role in determining your insurance quote. Areas prone to natural disasters, such as hurricanes, floods, or earthquakes, may carry higher premiums due to the increased risk. Similarly, neighborhoods with higher crime rates or a history of claims can also impact the cost.

- Home Value and Construction: The value and construction of your home are crucial factors. More expensive homes or those built with premium materials may require higher coverage limits, which can result in increased premiums. Additionally, the age and condition of your home can also affect the quote, as older homes may require more extensive coverage.

- Coverage Limits: The amount of coverage you choose for your home and its contents directly impacts your insurance quote. Higher coverage limits provide more financial protection but also increase the cost. It's essential to strike a balance between adequate coverage and affordability.

- Deductibles: Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, as you're assuming a greater share of the financial responsibility. Choosing the right deductible involves considering your financial comfort level and the potential risks.

- Policy Features and Add-ons: House insurance policies offer various coverage options and add-ons. These can include additional coverage for specific items, such as jewelry or artwork, or optional features like liability protection for accidents on your property. While these add-ons enhance your protection, they may also increase your overall premium.

Benefits of House Insurance

House insurance provides numerous benefits that go beyond the financial protection it offers. Here are some key advantages of securing adequate homeowners insurance:

- Protection against Financial Loss: The primary benefit of house insurance is safeguarding your financial well-being. In the event of a covered loss, such as a fire, storm damage, or burglary, your insurance policy can provide compensation for the cost of repairs, replacements, or rebuilding. This protection ensures you're not left with a significant financial burden.

- Peace of Mind: Knowing that your home and its contents are insured brings peace of mind. You can rest assured that, should an unforeseen event occur, you have the support and resources to recover and rebuild. This peace of mind allows you to focus on your daily life without worrying about potential disasters.

- Liability Coverage: House insurance policies often include liability coverage, which protects you from financial losses resulting from accidents or injuries that occur on your property. This coverage can provide financial assistance if a guest or passerby sustains an injury and decides to take legal action.

- Protection for Personal Belongings: Your house insurance policy typically covers not only the structure of your home but also the contents inside. This includes furniture, electronics, clothing, and other personal items. In the event of a loss, you can receive compensation for the replacement or repair of these belongings.

- Additional Living Expenses: In the unfortunate event that your home becomes uninhabitable due to a covered loss, house insurance policies often provide coverage for additional living expenses. This coverage helps cover the cost of temporary accommodation and other expenses incurred while you're unable to reside in your home.

Choosing the Right House Insurance

Selecting the right house insurance policy involves careful consideration of your specific needs and circumstances. Here are some key factors to keep in mind when making your choice:

- Coverage Limits: Ensure that the coverage limits of your policy align with the replacement cost of your home and its contents. It's essential to have sufficient coverage to fully protect your investment.

- Policy Features: Review the policy features and coverage options to determine if they meet your specific needs. Consider any add-ons or endorsements that may be necessary to provide comprehensive protection.

- Deductibles: Choose a deductible that strikes a balance between affordability and financial comfort. While higher deductibles can lower premiums, ensure you can afford the out-of-pocket expense if needed.

- Reputation and Financial Strength: Research the reputation and financial stability of the insurance company. Opt for a reputable provider with a strong financial standing to ensure they can fulfill their obligations in the event of a claim.

- Customer Service and Claims Handling: Assess the quality of customer service and claims handling processes. Choose an insurer with a track record of prompt and efficient claim settlements, ensuring you receive the support you need when it matters most.

The Claims Process and Tips

Understanding the claims process and being prepared can make a significant difference in the outcome of your claim. Here are some valuable tips to keep in mind:

- Document Your Property: Take inventory of your belongings and create a detailed record, including photographs and videos. This documentation can be crucial in supporting your claim and ensuring accurate compensation.

- Understand Your Policy: Familiarize yourself with your insurance policy and its coverage limits and exclusions. Knowing what is and isn't covered can help you make informed decisions during the claims process.

- Promptly Report Claims: Notify your insurance company as soon as possible after a loss occurs. Delays in reporting can potentially impact the processing of your claim.

- Provide Accurate Information: When filing a claim, provide accurate and detailed information. Misrepresenting facts or omitting relevant details can lead to claim denials or delays.

- Keep Records and Receipts: Maintain organized records and receipts related to your claim, including repair estimates, invoices, and any other relevant documentation. These records can support your claim and facilitate the claims settlement process.

Future Implications and Considerations

House insurance is an ongoing commitment, and staying informed about potential changes and considerations is essential. Here are some key points to keep in mind for the future:

- Policy Reviews: Regularly review your house insurance policy to ensure it continues to meet your needs. Life circumstances and the value of your home may change over time, requiring adjustments to your coverage.

- Natural Disaster Preparedness: Assess the risks associated with natural disasters in your area and take appropriate preventive measures. Implementing disaster preparedness strategies can reduce the likelihood and impact of potential losses.

- Home Maintenance: Regularly maintain and upgrade your home to mitigate potential risks. Well-maintained homes are often viewed more favorably by insurance providers and may even qualify for discounts or lower premiums.

- Bundling Insurance Policies: Consider bundling your house insurance with other policies, such as auto insurance or life insurance. Bundling can often result in discounts and streamlined coverage management.

- Keep Updated with Changes: Stay informed about any changes in your local area that may impact your insurance coverage, such as new construction projects or environmental factors. Being aware of these changes can help you anticipate potential risks and adjust your coverage accordingly.

| Insurance Provider | Average Annual Premium |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,450 |

| Provider C | $1,150 |

| Provider D | $1,320 |

Frequently Asked Questions

How often should I review my house insurance policy?

+It's recommended to review your house insurance policy annually, especially after significant life changes such as renovations, additions, or major purchases. Regular reviews ensure your coverage remains adequate and aligned with your needs.

What are some common exclusions in house insurance policies?

+Common exclusions in house insurance policies include damage caused by floods, earthquakes, and pests. It's essential to understand these exclusions to ensure you have additional coverage if needed.

Can I customize my house insurance policy to fit my specific needs?

+Yes, most house insurance policies offer customizable options and endorsements to cater to your specific requirements. You can add coverage for valuable items, increase liability limits, or include additional protection for specific risks.

What should I do if I need to file a claim for house insurance?

+If you need to file a claim, promptly notify your insurance company and provide detailed information about the loss. Follow their instructions and gather any necessary documentation to support your claim. Stay in communication with your insurer throughout the claims process.

House insurance quotes are a crucial step in safeguarding your home and providing financial protection. By understanding the factors that influence quotes, the benefits of house insurance, and the considerations for choosing the right policy, you can make an informed decision to protect your valuable assets. Remember to regularly review your coverage, stay informed about potential risks, and maintain open communication with your insurance provider to ensure a smooth and stress-free claims process.