Lemonade Insurance Renters

In the dynamic world of insurance, where traditional norms are being challenged, Lemonade Insurance emerges as a groundbreaking force, revolutionizing the way renters approach their insurance needs. This article delves into the innovative offerings of Lemonade Insurance for renters, exploring its unique features, benefits, and impact on the industry.

The Lemonade Insurance Revolution: A New Era for Renters

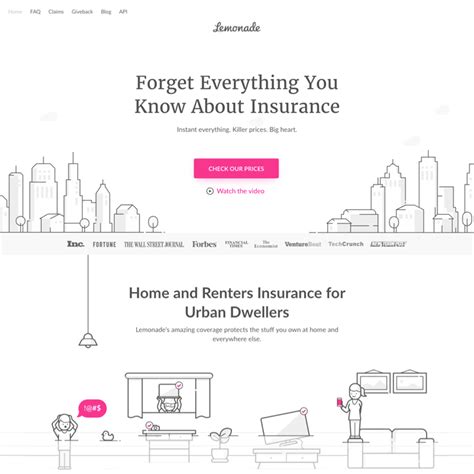

Lemonade Insurance, a digital insurance company, has disrupted the traditional insurance landscape by introducing a fresh, tech-driven approach. Its mission is to simplify insurance, making it accessible, transparent, and beneficial for all, including renters who often face unique challenges when seeking insurance coverage.

Understanding the Traditional Renters’ Insurance Dilemma

Historically, renters have faced complexities when navigating the insurance market. Traditional insurance companies often offer renters limited coverage options, with policies that can be confusing and expensive. The process of obtaining and understanding renters’ insurance can be daunting, leading to many renters either underinsuring or avoiding insurance altogether.

This dilemma stems from a lack of clarity in policy terms, lengthy application processes, and the perception that insurance is an unnecessary expense. As a result, many renters find themselves vulnerable to unforeseen events, such as natural disasters, theft, or accidents, without adequate protection.

Lemonade’s Vision: Democratizing Renters’ Insurance

Lemonade Insurance aims to transform this narrative by democratizing renters’ insurance, making it accessible, affordable, and understandable for all. Their innovative approach revolves around leveraging technology to create a seamless, efficient, and user-friendly insurance experience.

At its core, Lemonade's vision is to provide comprehensive coverage tailored to renters' specific needs. This includes not just basic property protection but also liability coverage, personal property coverage, and additional living expenses in the event of a covered loss.

Unveiling Lemonade’s Renters’ Insurance Offering

Lemonade’s renters’ insurance policy is designed to offer renters peace of mind and financial protection without the complexities typically associated with traditional insurance.

Comprehensive Coverage

Lemonade’s renters’ insurance provides broad coverage, including protection for personal property, liability, and additional living expenses. This comprehensive approach ensures that renters are adequately protected against a wide range of potential risks, from theft and fire to liability claims.

Personal property coverage ensures that renters' belongings are insured, offering financial support in the event of loss or damage. Liability coverage protects renters from lawsuits arising from accidents or injuries that occur on their rental property. Additionally, additional living expenses coverage provides financial assistance if a renter needs to relocate temporarily due to a covered loss.

Transparent and Affordable Pricing

One of the standout features of Lemonade’s renters’ insurance is its transparent and affordable pricing model. Lemonade believes in providing clear, upfront pricing, eliminating the confusion often associated with insurance premiums. Their policies are designed to be competitively priced, ensuring renters can access comprehensive coverage without breaking the bank.

Lemonade's use of advanced risk assessment tools and data analytics allows them to offer precise and fair pricing. This technology-driven approach ensures that renters are not overcharged for their insurance coverage, making it an attractive and affordable option.

User-Friendly Experience

Lemonade’s digital-first approach has revolutionized the insurance application and claims process. Renters can obtain quotes, purchase policies, and manage their insurance entirely online or via the Lemonade app. The intuitive platform makes it easy for renters to understand their coverage and make informed decisions.

The claims process is equally streamlined. Renters can file claims online, providing a simple and convenient experience. Lemonade's AI-powered technology assists in processing claims efficiently, often resulting in quick payouts. This user-friendly experience sets Lemonade apart, offering a level of convenience and simplicity not often found in the traditional insurance market.

Impact on the Insurance Industry

Lemonade’s innovative approach to renters’ insurance has had a significant impact on the industry. Their success has prompted traditional insurers to reevaluate their offerings, introducing more digital-friendly processes and competitive pricing structures. This shift towards digital transformation and customer-centricity is a direct result of Lemonade’s disruptive presence in the market.

Furthermore, Lemonade's focus on social good and giving back has inspired a new wave of insurance companies to adopt similar models. Lemonade donates a portion of their premiums to causes chosen by their policyholders, fostering a sense of community and social responsibility. This unique business model has not only disrupted the insurance industry but has also influenced a broader cultural shift towards more ethical and transparent business practices.

| Coverage Type | Key Features |

|---|---|

| Personal Property | Protects renters' belongings against loss or damage |

| Liability | Covers lawsuits arising from accidents or injuries on rental property |

| Additional Living Expenses | Provides financial support for temporary relocation due to a covered loss |

The Future of Renters’ Insurance: Lemonade’s Vision

Looking ahead, Lemonade Insurance continues to innovate and expand its offerings. They are dedicated to enhancing the renters’ insurance experience, making it even more personalized and beneficial.

Expanding Coverage Options

Lemonade is committed to offering renters a wide range of coverage options to suit their specific needs. This includes exploring additional add-ons and enhancements to their existing policies. By providing renters with the flexibility to customize their coverage, Lemonade ensures that renters can protect themselves adequately without unnecessary expenses.

Advancing Digital Transformation

Lemonade recognizes the importance of staying at the forefront of digital innovation. They continue to invest in advanced technologies, such as AI and machine learning, to enhance their platform and streamline the insurance experience for renters. This includes developing more intuitive interfaces, faster claims processing, and innovative tools to help renters better understand and manage their insurance.

Community Engagement and Social Impact

Lemonade’s unique approach to giving back and engaging with the community remains a key focus. They are committed to continuing their social impact initiatives, ensuring that a portion of their premiums continue to support causes chosen by their policyholders. This not only strengthens their social responsibility but also fosters a deeper connection with their renters, creating a community-oriented insurance experience.

Partnering for Growth

Lemonade is open to strategic partnerships that align with their vision and values. By collaborating with like-minded organizations, they aim to expand their reach and offer renters even more comprehensive protection. These partnerships could include collaborations with real estate companies, rental platforms, or other service providers in the rental industry, creating a seamless experience for renters.

Conclusion: A New Paradigm for Renters’ Insurance

Lemonade Insurance has undeniably reshaped the landscape of renters’ insurance, offering a fresh, innovative approach that prioritizes accessibility, affordability, and social impact. Their success lies in their ability to understand renters’ unique needs and provide tailored solutions that offer peace of mind and financial protection.

As Lemonade continues to lead the way, the future of renters' insurance looks promising. With their commitment to innovation, digital transformation, and community engagement, Lemonade is poised to set new standards in the industry, making insurance a beneficial and rewarding experience for renters.

How does Lemonade’s renters’ insurance compare to traditional policies in terms of cost?

+

Lemonade’s renters’ insurance often provides more competitive pricing compared to traditional policies. Their use of advanced risk assessment tools and data analytics allows them to offer precise and fair pricing, ensuring renters aren’t overcharged for their coverage.

What sets Lemonade’s claims process apart from traditional insurers?

+

Lemonade’s claims process is streamlined and user-friendly. Renters can file claims online or via the Lemonade app, and the company’s AI-powered technology assists in quick and efficient processing. This results in faster payouts compared to traditional insurers, who often have more manual and time-consuming claims processes.

How does Lemonade’s social impact initiative work, and what causes do they support?

+

Lemonade donates a portion of their premiums to causes chosen by their policyholders. This initiative, known as Giveback, allows renters to support charities and non-profit organizations of their choice. The causes range from environmental initiatives to educational programs and disaster relief efforts, reflecting Lemonade’s commitment to social responsibility and community engagement.