State Farm Insurance Life

In the vast landscape of insurance providers, State Farm stands as a beacon of reliability and trust. With a rich history spanning over a century, State Farm has evolved into a leading name in the insurance industry, offering a comprehensive range of services that cater to the diverse needs of its customers. This article delves into the world of State Farm Insurance Life, exploring its offerings, impact, and the reasons behind its enduring success.

A Legacy of Service: State Farm’s Journey

State Farm Insurance was founded in 1922 by a visionary entrepreneur, George J. Mecherle, with a simple yet powerful mission: to provide affordable and accessible auto insurance to the hardworking farmers and rural motorists of Illinois. From these humble beginnings, State Farm has grown into one of the largest insurance providers in the United States, with a global reach and a reputation for excellence.

The company's journey is a testament to its commitment to innovation and customer satisfaction. Over the years, State Farm expanded its offerings to include not just auto insurance, but also a wide array of products such as home, life, health, and business insurance. This diversification allowed State Farm to become a one-stop solution for all insurance needs, catering to individuals, families, and businesses alike.

Key Milestones in State Farm’s History

State Farm’s growth has been marked by several significant milestones that have shaped its position in the industry. Here are some notable events:

- 1922: State Farm is founded, initially offering auto insurance to farmers.

- 1925: The company introduces a unique system of local agents, a model that becomes a cornerstone of its success.

- 1929: Despite the Great Depression, State Farm expands its services to include fire insurance, showcasing its resilience.

- 1946: State Farm enters the life insurance market, offering policies to protect families.

- 1950s: The company diversifies further, introducing health insurance and other specialized products.

- 1990s: State Farm embraces technology, launching its online services and mobile apps for enhanced customer convenience.

- 2000s: The company continues to innovate, offering digital tools for policy management and claims processing.

Each milestone represents State Farm's adaptability and its ability to meet the evolving needs of its customers. This commitment to staying ahead of the curve has been a key driver of its success and has solidified its position as a trusted partner for millions of individuals and businesses.

State Farm’s Life Insurance: A Comprehensive Overview

State Farm’s life insurance offerings are designed to provide financial protection and peace of mind to policyholders and their loved ones. With a range of products tailored to different needs and life stages, State Farm ensures that individuals can find a policy that aligns with their unique circumstances.

Term Life Insurance

Term life insurance is a popular choice for those seeking affordable coverage for a specific period. State Farm offers term life policies with flexible terms ranging from 10 to 30 years. These policies provide a death benefit to the beneficiary in the event of the insured’s passing during the policy term. Some key features include:

- Affordable premiums: State Farm's term life insurance is known for its competitive pricing, making it accessible to a wide range of individuals.

- Renewable options: Policyholders can renew their term life policies, often with the option to convert to a permanent life insurance plan.

- Conversion privileges: Many State Farm term life policies offer the ability to convert to a permanent plan without additional medical underwriting.

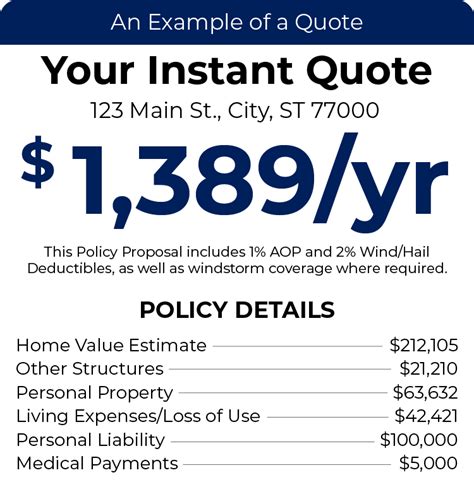

| Policy Type | Coverage Period | Average Annual Premium |

|---|---|---|

| 10-Year Term | 10 years | $250 - $500 |

| 20-Year Term | 20 years | $400 - $800 |

| 30-Year Term | 30 years | $600 - $1200 |

State Farm's term life insurance is an excellent option for individuals who want temporary coverage, such as covering a mortgage or providing financial security during their working years.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the insured’s entire life, as long as premiums are paid. State Farm offers several types of permanent life insurance policies, each with its own unique features and benefits:

- Whole Life Insurance: This policy provides a guaranteed death benefit, cash value growth, and the option to borrow against the policy's cash value.

- Universal Life Insurance: Offering flexibility in premium payments and death benefit amounts, universal life insurance is ideal for those seeking customization.

- Variable Life Insurance: With investment options that allow policyholders to direct their premiums, variable life insurance offers the potential for higher returns but also carries more risk.

Permanent life insurance is often chosen by individuals who want long-term financial protection and the opportunity to build cash value over time. State Farm's range of permanent life insurance products ensures that policyholders can find a plan that aligns with their financial goals and risk tolerance.

Additional Benefits and Riders

State Farm’s life insurance policies come with a variety of optional riders and benefits that can be added to enhance coverage. These include:

- Waiver of Premium: This rider waives premium payments if the insured becomes disabled.

- Accelerated Death Benefit: Allows for an advance payment of a portion of the death benefit if the insured is diagnosed with a terminal illness.

- Child Rider: Provides a death benefit for the insured's children, offering financial protection in the event of an unexpected tragedy.

- Spouse Rider: Extends coverage to the insured's spouse, ensuring that both partners are protected under the same policy.

These riders and benefits allow policyholders to customize their life insurance coverage, ensuring that their specific needs and concerns are addressed.

The Impact of State Farm’s Life Insurance

State Farm’s life insurance offerings have had a significant impact on the lives of its policyholders. By providing affordable and accessible coverage, State Farm has empowered individuals and families to protect their financial futures and ensure the well-being of their loved ones. Here are some key ways in which State Farm’s life insurance has made a difference:

Financial Security and Peace of Mind

Life insurance is a crucial tool for financial planning, and State Farm’s policies offer a safety net for policyholders and their families. In the event of an unexpected passing, the death benefit can help cover funeral expenses, pay off debts, and provide income for dependents, ensuring that loved ones are not left in financial distress.

Educational and Legacy Planning

State Farm’s life insurance policies often include options for riders that can be used to fund education expenses for beneficiaries. This allows policyholders to leave a legacy of educational opportunities for their children or grandchildren. Additionally, permanent life insurance policies can be used as a vehicle for long-term savings and estate planning, ensuring that assets are passed on efficiently and effectively.

Business Continuity

For business owners, State Farm’s life insurance policies offer a way to protect their businesses in the event of their passing. By purchasing a life insurance policy, business owners can ensure that their business has the financial resources to continue operations, pay off debts, and potentially fund a transition plan. This helps maintain the business’s stability and ensures that the owner’s legacy can live on.

Community Impact

State Farm’s commitment to its customers extends beyond providing insurance products. The company actively engages in community initiatives and charitable endeavors. Through its State Farm Good Neighbor program, the company supports various causes, including education, disaster relief, and youth development. This commitment to giving back strengthens the bond between State Farm and its policyholders, creating a sense of shared responsibility and community.

State Farm’s Digital Revolution

In an era defined by technological advancements, State Farm has embraced digital innovation to enhance its customer experience. The company’s online and mobile platforms offer a seamless and efficient way for policyholders to manage their insurance needs. From purchasing a policy to filing a claim, State Farm’s digital tools make the process more accessible and convenient.

Online Policy Management

State Farm’s online portal allows policyholders to view and manage their insurance policies from the comfort of their homes. Users can access their policy details, make payments, update personal information, and even print proof of insurance. This level of convenience saves time and effort, ensuring that policyholders can stay on top of their insurance needs without unnecessary hassle.

Mobile Apps

State Farm’s mobile apps take convenience to the next level. Available for both iOS and Android devices, these apps provide policyholders with on-the-go access to their insurance information. Users can quickly view policy details, file claims, and even use the app’s GPS-enabled features to locate the nearest State Farm agent or repair shop. The apps also offer a range of tools, such as a digital ID card and a coverage calculator, to help policyholders make informed decisions about their insurance needs.

Digital Claims Processing

State Farm’s digital transformation has also streamlined the claims process. Policyholders can now file claims online or through the mobile app, providing a more efficient and paperless experience. The company’s claims team utilizes advanced technology to process claims quickly and accurately, ensuring that policyholders receive the support they need during times of uncertainty.

State Farm’s Future Outlook

As the insurance industry continues to evolve, State Farm remains at the forefront, adapting to meet the changing needs of its customers. The company’s focus on innovation, customer service, and community involvement positions it well for future success. With a strong foundation and a commitment to continuous improvement, State Farm is poised to remain a leading force in the insurance landscape for years to come.

In an increasingly digital world, State Farm recognizes the importance of staying ahead of the curve. The company is investing in cutting-edge technologies, such as artificial intelligence and blockchain, to enhance its services and improve customer experiences. By leveraging these technologies, State Farm aims to offer even more personalized and efficient insurance solutions, ensuring that its policyholders receive the best possible protection and support.

Furthermore, State Farm's dedication to community engagement and social responsibility is expected to continue strengthening its brand and reputation. By actively giving back and supporting causes that matter to its policyholders, State Farm fosters a sense of trust and loyalty, solidifying its position as a trusted partner for generations to come.

What sets State Farm’s life insurance apart from other providers?

+State Farm’s life insurance stands out for its comprehensive range of products, competitive pricing, and focus on customer service. The company’s commitment to innovation and its network of local agents make it a trusted choice for many individuals and families.

How do I choose between term and permanent life insurance?

+The choice between term and permanent life insurance depends on your specific needs and financial goals. Term life insurance is often more affordable and suitable for temporary coverage needs, while permanent life insurance provides lifelong protection and the potential for cash value growth.

Can I customize my State Farm life insurance policy?

+Absolutely! State Farm offers a range of optional riders and benefits that allow you to tailor your policy to your unique circumstances. Whether you want to add a waiver of premium rider or include a child rider, State Farm provides flexibility to meet your specific needs.