Why Did My Progressive Insurance Go Up

As a policyholder, you may have noticed that your Progressive insurance premiums can fluctuate over time. This increase in insurance rates is a common concern among many individuals, and it's essential to understand the underlying factors that contribute to these changes. Progressive Insurance, one of the leading providers in the industry, bases its premium calculations on various risk factors to ensure fair pricing. In this comprehensive article, we will delve into the reasons behind the potential increase in your Progressive insurance rates, providing you with valuable insights and an in-depth analysis.

Understanding Progressive’s Premium Calculation

Progressive Insurance utilizes a comprehensive risk assessment model to determine insurance premiums. This model takes into account numerous factors that influence the likelihood of claims and the overall risk associated with insuring a particular vehicle or individual. By considering these factors, Progressive aims to offer accurate and fair pricing to its customers.

Key Factors Influencing Progressive Insurance Rates

The increase in your Progressive insurance premiums can be attributed to several key factors. Here are some of the most significant considerations:

- Vehicle Type and Usage: The make, model, and age of your vehicle play a crucial role in determining your insurance rates. High-performance vehicles or those with a history of frequent accidents may be considered higher risk, leading to increased premiums.

- Driving History: Your driving record is a critical factor. If you have a history of accidents, traffic violations, or claims, Progressive may classify you as a higher-risk driver, resulting in higher insurance costs.

- Coverage and Deductibles: The level of coverage you choose and your deductible amounts can impact your premiums. Higher coverage limits and lower deductibles often result in increased costs.

- Location and Claims History: The area where you reside or frequently drive can influence your rates. Regions with a higher incidence of accidents or claims may have higher average insurance costs. Additionally, Progressive considers the claims history of your specific location.

- Credit Score: Surprisingly, your credit score can affect your insurance premiums. Many insurance companies, including Progressive, believe that individuals with lower credit scores tend to file more claims, so they may charge higher rates.

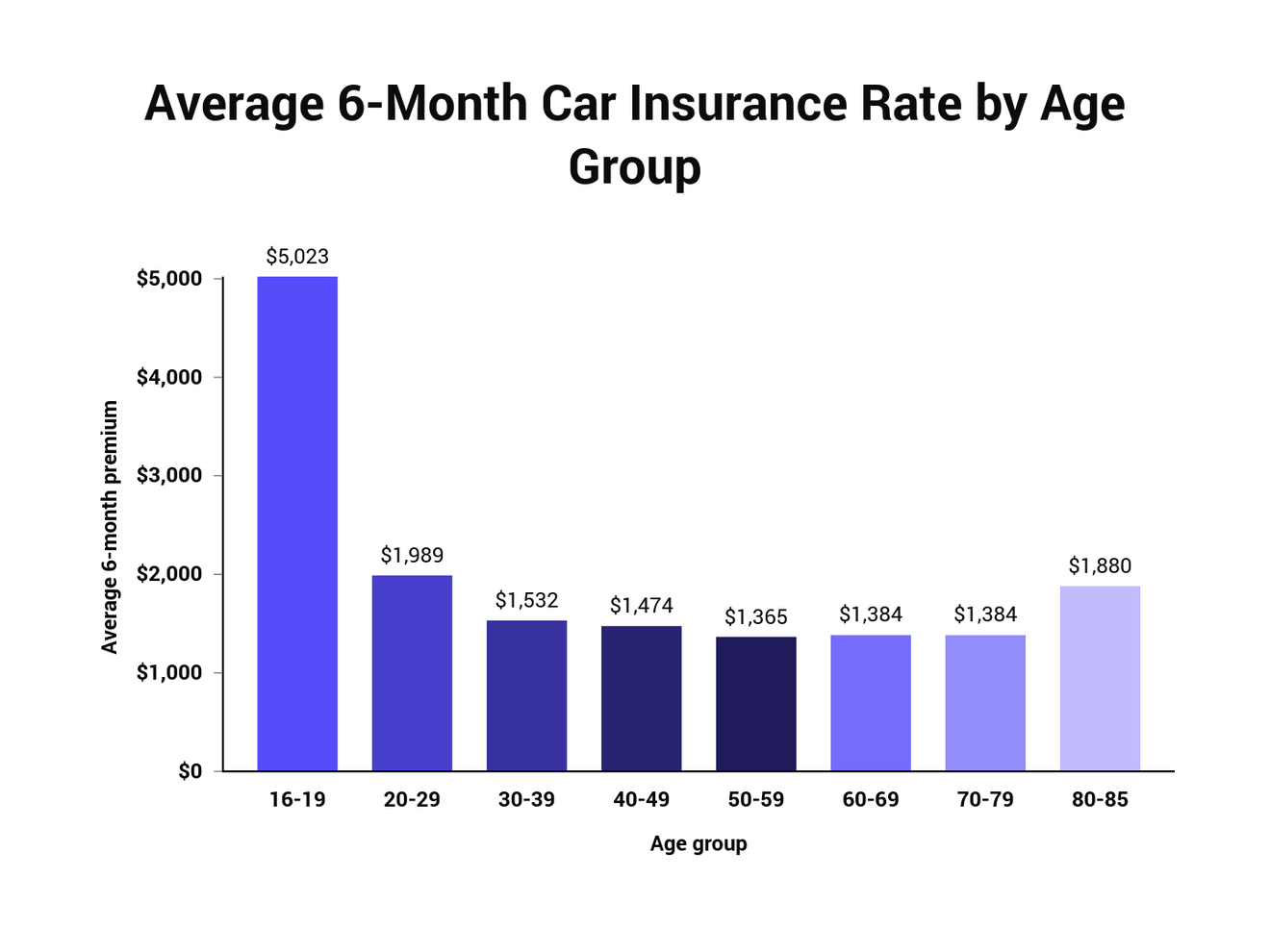

- Age and Gender: Progressive, like many insurers, takes into account age and gender when calculating rates. Young drivers, especially males, are often considered higher risk due to their lack of driving experience and higher likelihood of accidents.

- Policy Add-ons and Discounts: The additional coverage options and discounts you choose can impact your overall premium. While add-ons may increase costs, certain discounts can help offset these increases.

Progressive’s Risk Assessment Model in Action

To illustrate how Progressive’s risk assessment model works, let’s consider a hypothetical scenario. Imagine you recently purchased a new sports car, and your insurance rates have significantly increased. Here’s a breakdown of the factors that could contribute to this increase:

| Factor | Impact on Rates |

|---|---|

| Vehicle Type | Sports cars are often associated with higher accident risks and more frequent claims, leading to increased premiums. |

| Driving History | If you have a clean driving record with no accidents or violations, Progressive may offer a discount, but a history of accidents could result in higher rates. |

| Coverage | Opting for comprehensive coverage with low deductibles can increase your premiums. However, it's important to strike a balance between coverage and cost. |

| Location | If you live in an urban area with a high incidence of accidents or theft, your rates may be higher. Progressive considers the specific risks associated with your location. |

| Credit Score | A lower credit score could impact your rates negatively, as it may be seen as an indicator of increased risk. |

Managing Your Progressive Insurance Costs

Understanding the factors that influence your Progressive insurance rates is the first step in managing your costs effectively. Here are some strategies to consider:

Review Your Policy Regularly

Stay informed about your policy details and regularly review your coverage. Ensure that the information provided to Progressive is accurate and up-to-date. Inaccurate information can lead to incorrect risk assessments and higher premiums.

Explore Discounts and Savings

Progressive offers various discounts and savings opportunities. These may include multi-policy discounts, safe driver discounts, and loyalty rewards. By taking advantage of these options, you can potentially lower your insurance costs.

Consider Higher Deductibles

Increasing your deductible can reduce your insurance premiums. However, it’s essential to ensure that you have the financial means to cover a higher deductible in the event of a claim. Striking the right balance between coverage and cost is crucial.

Maintain a Clean Driving Record

A safe and responsible driving record is key to keeping your insurance rates low. Avoid traffic violations and accidents to maintain a positive driving history. Progressive rewards safe drivers with lower premiums.

Shop Around for Competitive Rates

While Progressive is a well-known insurer, it’s always a good idea to compare rates with other reputable insurance companies. Shopping around can help you identify the best value for your insurance needs.

Future Implications and Industry Insights

The insurance industry is constantly evolving, and Progressive, like other providers, adapts its pricing strategies to remain competitive. Here are some future implications and industry insights to consider:

Technological Advances in Risk Assessment

Progressive and other insurers are leveraging technology to enhance their risk assessment models. This includes the use of telematics devices, which track driving behavior and provide real-time data on factors like speeding, harsh braking, and acceleration. These devices can help insurers accurately assess risk and offer personalized premiums.

Data-Driven Pricing

Insurers are increasingly using data analytics to identify patterns and trends in claims and risks. This data-driven approach allows them to refine their pricing models and offer more accurate and fair premiums. Progressive’s use of data analytics contributes to its reputation for competitive pricing.

Personalized Insurance Plans

The future of insurance may see the emergence of more personalized plans. Progressive and other insurers are exploring ways to offer customized coverage options based on individual needs and risk profiles. This could lead to more tailored and affordable insurance solutions.

Conclusion: Taking Control of Your Insurance Costs

Understanding the reasons behind an increase in your Progressive insurance premiums empowers you to make informed decisions. By staying informed about the factors that influence your rates and implementing strategies to manage your costs, you can ensure that your insurance remains affordable and tailored to your needs. Progressive’s focus on innovation and fair pricing makes it a reliable choice for many policyholders.

Can I negotiate my Progressive insurance rates?

+While Progressive sets its rates based on risk assessment, you can still negotiate with their agents. Review your policy, discuss any changes in your circumstances, and explore options for discounts to potentially lower your premiums.

How often do Progressive insurance rates change?

+Progressive reviews its rates periodically, typically annually or semi-annually. However, significant changes in your circumstances or the insurance market can trigger more frequent rate adjustments.

What happens if I don’t pay my Progressive insurance premium?

+If you fail to pay your insurance premium, Progressive may cancel your policy. It’s essential to maintain timely payments to avoid lapses in coverage and potential legal consequences.