Compare Quotes Car Insurance

In the world of car insurance, finding the best policy that suits your needs and budget can be a daunting task. With numerous providers offering competitive rates and a wide range of coverage options, it's essential to compare quotes thoroughly. This article aims to guide you through the process of comparing car insurance quotes, highlighting key factors to consider, and providing valuable insights to help you make an informed decision.

Understanding the Basics of Car Insurance Quotes

Car insurance quotes are tailored estimates provided by insurance companies based on various factors, including your personal information, vehicle details, and driving history. These quotes outline the coverage options, premiums, and any additional benefits or exclusions. By comparing quotes, you can evaluate the cost and coverage aspects, ensuring you find the most suitable policy.

Factors Influencing Car Insurance Quotes

Several elements contribute to the calculation of car insurance quotes. Understanding these factors can help you navigate the comparison process effectively.

- Personal Information: Your age, gender, marital status, and location play a significant role. For instance, young drivers or those residing in high-risk areas may face higher premiums.

- Vehicle Details: The make, model, and year of your vehicle impact the quote. Additionally, the usage of your vehicle, such as daily commuting or occasional leisure trips, influences the premium.

- Driving History: Your past driving record, including accidents, claims, and traffic violations, is carefully assessed. A clean driving record often leads to more favorable quotes.

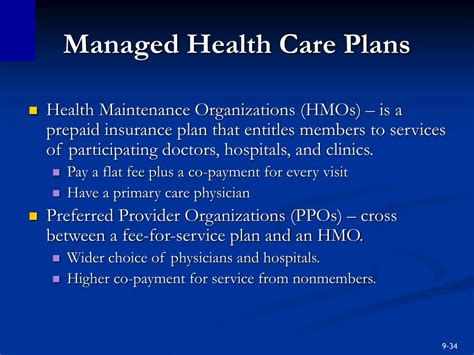

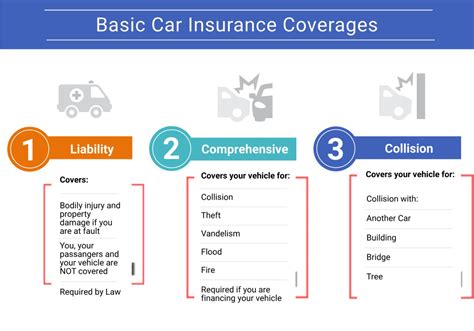

- Coverage Options: Car insurance policies offer various coverage types, such as liability, collision, comprehensive, and personal injury protection. The level of coverage you choose affects the overall quote.

- Discounts and Bundles: Many insurance providers offer discounts for safe driving, multiple policies (home and auto), or loyalty. Bundling your insurance needs can result in substantial savings.

The Comparison Process: Step-by-Step Guide

To ensure a thorough comparison, follow these steps:

- Define Your Needs: Begin by assessing your specific requirements. Determine the level of coverage you desire, whether it’s basic liability or comprehensive protection. Consider any additional benefits you may need, such as rental car coverage or roadside assistance.

- Research Multiple Insurers: Explore a range of reputable insurance companies. Utilize online comparison tools, but also consider reaching out to local brokers or agents for personalized recommendations.

- Gather Accurate Information: Prepare a comprehensive list of details about yourself and your vehicle. This includes your driver’s license number, vehicle identification number (VIN), and any relevant documents or records. Accuracy is crucial to obtain precise quotes.

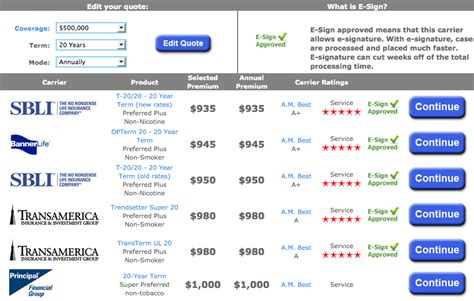

- Request Quotes: Contact the selected insurers or use their online platforms to request quotes. Provide the necessary information and specify your desired coverage levels. Ensure you receive quotes for similar coverage options to facilitate an apples-to-apples comparison.

- Analyze the Quotes: Compare the quotes based on premiums, coverage limits, deductibles, and any additional benefits or exclusions. Pay attention to the fine print and understand the terms and conditions. Calculate the potential out-of-pocket expenses for different scenarios, such as accidents or comprehensive claims.

- Consider Customer Service and Reputation: Research the insurer’s reputation and customer satisfaction ratings. Check online reviews and seek recommendations from trusted sources. A reliable insurer with excellent customer service can provide peace of mind in case of claims.

- Evaluate Discounts and Bundles: Assess the availability of discounts and the potential savings from bundling multiple policies. Some insurers offer discounts for safe driving, good student grades, or even specific professions. Bundle your home and auto insurance to maximize savings.

- Review Payment Options: Consider the payment flexibility and any potential fees associated with different payment plans. Some insurers offer monthly or quarterly payment options, while others may charge fees for installment plans.

- Seek Professional Advice: If you’re unsure about certain aspects or have complex insurance needs, consult an independent insurance broker. They can provide expert guidance and help you navigate the comparison process effectively.

Key Considerations for an Informed Decision

When comparing car insurance quotes, keep the following considerations in mind:

- Coverage Adequacy: Ensure the policy provides sufficient coverage for your needs. Consider the potential risks and costs associated with your vehicle and driving habits. Adequate coverage can protect you from financial burdens in case of accidents or claims.

- Price vs. Value: While price is an important factor, don’t solely base your decision on the lowest premium. Evaluate the overall value, considering the coverage, customer service, and financial stability of the insurer.

- Flexibility and Customization: Look for insurers that offer customizable policies to fit your specific needs. Some providers allow you to choose specific coverage limits, deductibles, and add-on options, providing greater flexibility.

- Claim Process and Response: Research the insurer’s claim process and response times. A prompt and efficient claims handling process can make a significant difference during times of need.

- Renewal Options: Understand the insurer’s renewal policies and any potential rate increases. Some insurers offer loyalty discounts or provide incentives for long-term customers.

Real-Life Examples and Case Studies

To illustrate the impact of comparing quotes, let’s explore a few real-life scenarios:

Scenario 1: Young Driver’s Quest for Affordable Insurance

John, a 22-year-old student, recently purchased his first car. He sought affordable insurance while ensuring adequate coverage. By comparing quotes from multiple insurers, John discovered that while some providers offered lower premiums, they had higher deductibles or limited coverage. After careful analysis, he opted for a policy with a slightly higher premium but better coverage and lower deductibles, providing him with the financial protection he needed.

Scenario 2: Family's Need for Comprehensive Coverage

The Smith family, with two teenage drivers, required comprehensive car insurance. They compared quotes from various insurers, considering factors like liability limits, collision coverage, and uninsured/underinsured motorist protection. By analyzing the quotes and understanding the family's specific needs, they selected a policy with higher liability limits and added rental car coverage, ensuring peace of mind for their growing family.

Performance Analysis and Future Implications

Comparing car insurance quotes not only helps individuals find the best coverage at the right price but also drives competition among insurers. As consumers become more informed and tech-savvy, insurers are forced to offer competitive rates and innovative coverage options. This dynamic market environment benefits consumers, leading to improved customer service, enhanced digital experiences, and more transparent pricing structures.

Furthermore, the comparison process allows insurers to identify trends and preferences among their target audience. By analyzing consumer behavior and feedback, insurers can refine their products and services, ultimately enhancing the overall customer experience. This iterative process fosters a healthier and more responsive insurance industry, ensuring that consumers receive the coverage they need and deserve.

| Insurers | Average Premium | Coverage Highlights |

|---|---|---|

| Company A | $1,200 annually | Comprehensive coverage, accident forgiveness, and roadside assistance |

| Company B | $1,150 annually | Liability-only coverage, flexible payment plans, and discount for safe driving |

| Company C | $1,350 annually | Full coverage, personalized deductibles, and rental car coverage |

FAQ

How often should I compare car insurance quotes?

+It’s recommended to compare quotes annually or whenever your circumstances change significantly, such as a new vehicle purchase, moving to a different location, or a change in marital status.

Can I negotiate car insurance rates with insurers?

+While negotiation may not be possible with all insurers, some providers offer flexibility. Contact your insurer to discuss your options and inquire about potential discounts or adjustments to your policy.

What factors can I control to lower my car insurance premiums?

+You can improve your driving record by avoiding accidents and traffic violations. Additionally, consider increasing your deductible, maintaining a good credit score, and exploring safe driver discounts or loyalty programs offered by insurers.